Back to all blogs

Clear ways to communicate interview fraud risks and prevention measures to hiring managers in a calm, actionable manner.

Abhishek Kaushik

Jan 8, 2026

Interview fraud is rising, but most hiring managers do not think it applies to their candidates.

The goal is not to scare them.

The goal is to frame fraud detection as quality control, not suspicion.

You will learn:

How to talk about fraud without sounding accusatory

How to position prevention as efficiency and risk reduction

Scripts for manager conversations

How to answer common objections confidently

Why Hiring Managers Push Back

Hiring managers often believe:

Fraud is rare

Recruiting should filter this before it reaches them

Fraud prevention slows the process

"I can tell if someone is lying"

None of these assumptions are accurate.

Key Truth

Fraud today is not sloppy or obvious.

It is professionalized.

A report shows 72% of recruiters have encountered AI-related fraud in hiring, including deepfake interviews and fake credentials, yet most organizations lack proper detection tools.

Fraud is not a hiring manager problem.

It is a pipeline integrity problem.

The Mindset Shift to Create

Do not say:

We are adding fraud checks.

This implies distrust.

Say:

We are improving interview accuracy and reducing rework.

This is the framing that drives alignment.

The Core Message Script

Here is the exact language to use.

Opening Positioning

Remote hiring has changed the behavior of candidates. It is now easier for people to receive outside help during interviews or even have someone else interview for them. Our goal is to ensure that the person we evaluate is the person who joins your team.

Benefit Statement

Fraud prevention is about protecting your time and ensuring your team does not inherit a performance problem later.

Accountability Framing

This is not about catching people. It is about confirming ability and identity with consistency.

Common Objections and How to Respond

Objection | What They Are Really Worried About | What to Say |

|---|---|---|

“This sounds like paranoia.” | They assume fraud is rare. | “We only use verification when signals indicate unclear ownership or identity. It is selective and structured.” |

“I know how to spot this.” | Confidence bias. | “Fraud today looks like confidence and fluency. We check reasoning depth, not tone or personality.” |

“Will this slow hiring down?” | Time pressure. | “Verification adds 3 to 6 minutes and prevents weeks of rework and onboarding reversal.” |

“Will candidates feel insulted?” | Candidate experience. | “We position it as fairness and consistency for all candidates. Most appreciate the clarity.” |

The Key Talking Points to Reinforce

1. Fraud Prevention Protects Hiring Manager Time

One mis-hire costs:

Weeks of onboarding

Team frustration

Performance remediation

Replacing the hire again

2. Fraud Prevention Improves Team Performance

Real performers integrate faster and contribute sooner.

3. Fraud Prevention is a Fairness Mechanism

It ensures:

Every candidate is evaluated consistently

No one has an unfair advantage

The best talent wins, not the best prep-hack

The Script for Introducing Prevention to a Hiring Panel

Use this before starting interviews:

Short. Neutral. Professional.

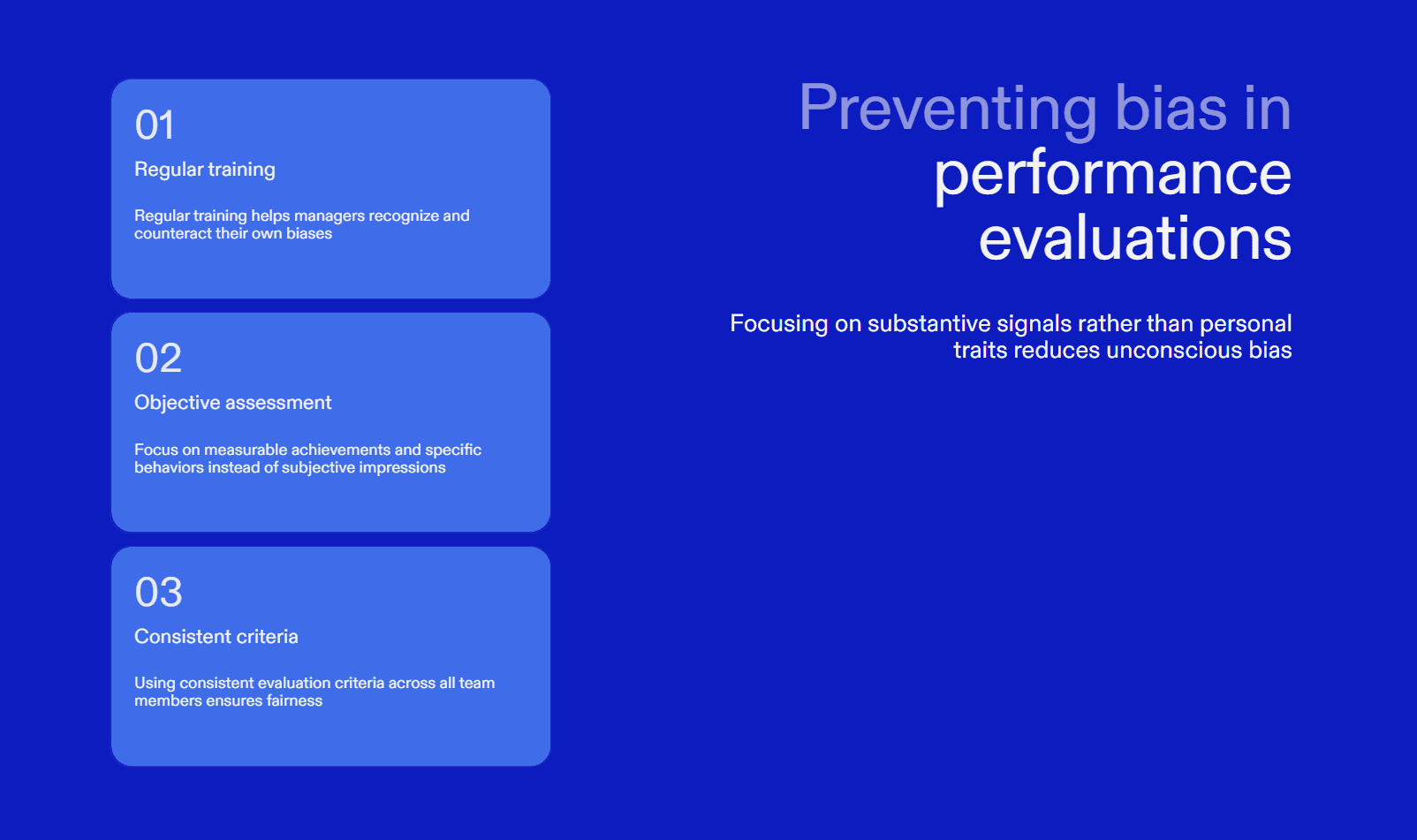

How to Train Managers to Recognize the Right Signals

Teach managers to look for:

Lack of personal ownership

Conflict-free narratives

Inability to adapt when constraints change

Rehearsed or overly polished delivery

Not:

Accent

Personality

Confidence

Eye contact

This prevents bias creep.

Conclusion

Fraud prevention is not about distrust.

It is about:

Protecting hiring managers

Preserving team performance

Reducing rework

Making decision-making more reliable

Positioning matters more than mechanics.

The message is:

We are increasing accuracy, not increasing suspicion.